Share

We connect the capital market with a promising asset class: commercial real estate.”

Our investors participate in our success in the form of value appreciation. Our communication is open, prompt and comprehensive.

Note: Please send voting rights notifications to stimmrechte@demire.ag

Price & information

Price & information

| Basic information | |

|---|---|

| Name | DEMIRE Deutsche Mittelstand Real Estate AG |

| ISIN | DE000A0XFSF0 |

| WKN | A0XFSF |

| Ticker symbol | DMRE |

| Number of shares (as at June 2020) | 107,777,324 |

| Market segment | Prime Standard |

| Open market | Berlin, Düsseldorf and Stuttgart |

| Prime Standard (regulated market) | Frankfurt Stock Exchange (Frankfurt and Xetra) |

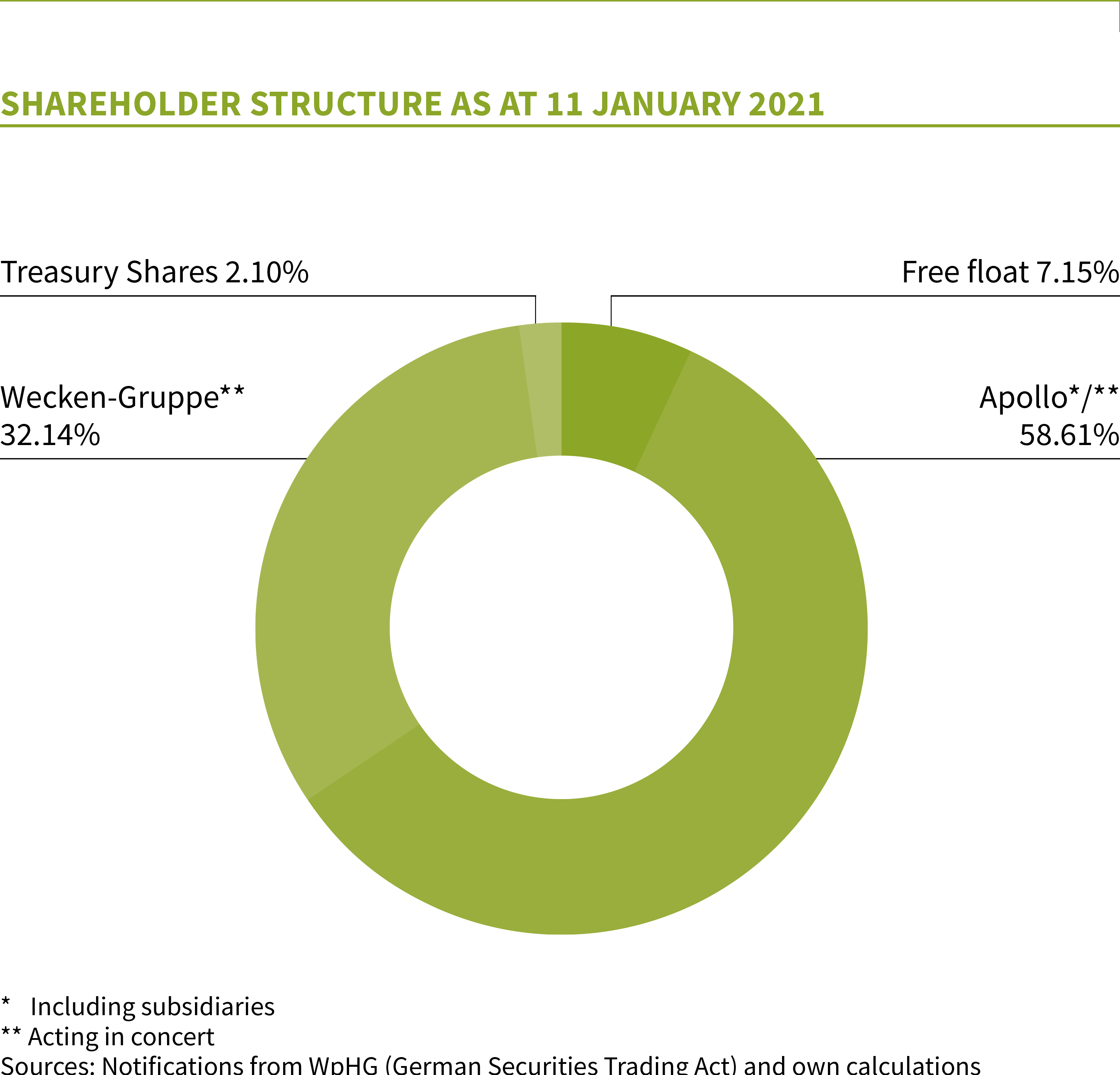

Shareholder structure

Our company bases its activities on a stable investor structure. This is the best way to build up value in the long term.

Share capital performance

Share capital performance

| Date of issue | Nature of capital increase | Number of shares outstanding | Share capital following capital increase in EUR |

|---|---|---|---|

| 28/12/2018 | Issue of subscription shares | 175,303 | 107,777,324 |

| 12/11/2018 | Authorised capital (cash capital increase) | 34,512,703 | 107,598,431 |

| 31/08/2018 | Issue of subscription shares | 4,650 | 73,085,728 |

| 31/07/2018 | Issue of subscription shares | 16,240 | 73,081,078 |

| 20/06/2018 | Issue of subscription shares | 10,271,560 | 73,064,838 |

| 30/05/2018 | Issue of subscription shares | 3,066,600 | 62,793,278 |

| 30/04/2018 | Issue of subscription shares | 12,020 | 59,726,678 |

| 05/04/2018 | Authorised capital (cash capital increase) | 5,425,774 | 59,714,658 |

| 29/03/2018 | Issue of subscription shares | 18,140 | 54,288,884 |

| 30/10/2017 | Issue of subscription shares | 9,000 | 54,270,744 |

| 31/08/2017 | Issue of subscription shares | 2,000 | 54,261,744 |

| 31/07/2017 | Issue of subscription shares | 2,000 | 54,259,744 |

| 28/04/2017 | Issue of subscription shares due to exercise of conversion rights from the 2013/2018 convertible bond | 1,800 | 54,257,744 |

| 31/01/2017 | Authorised capital (cash capital increase) | 9,000 | 54,255,944 |

| 30/09/2016 | Issue of subscription shares due to exercise of conversion rights from the 2013/2018 convertible bond | 4,500 | 54,246,944 |

| 01/09/2016 | Authorised capital (cash capital increase) | 4,930,722 | 54,242,444 |

| 31/08/2016 | Issue of subscription shares due to exercise of conversion rights from the 2013/2018 convertible bond | 4,500 | 49,317,222 |

| 29/02/2016 | Issue of subscription shares due to exercise of conversion rights from the 2013/2018 convertible bond | 14,937 | 49,307,222 |

| 31/12/2016 | Issue of subscription shares due to exercise of conversion rights from the 2013/2018 convertible bond | 13,125 | 49,292,285 |

| 21/12/2015 | Resolution of the Annual General Meeting of 14 September 2015 (non-cash capital increase) | 21,927,756 | 49,279,160 |

| 25/09/2015 | Issue of subscription shares due to exercise of conversion rights from the 2013/2018 convertible bond | 135,725 | 27,351,404 |

| 14/07/2015 | Authorised capital (cash capital increase) For the Wecken & Cie., Basel, Switzerland, investment to further expand the commercial real estate portfolio in Germany and to strengthen the company’s own financial power. | 2,474,152 | 27,215,679 * Excluding options from the 2013/2018 convertible bond that had been exercised by the date of the prospectus, unless already entered in the commercial register. |

| 01/07/2015 | Authorised capital (non-cash capital increase) Contribution of 94% of the shares in Logistikpark Leipzig GmbH for the acquisition of Logistikpark Leipzig. | 2,541,149 | 24,741,527 |

| 27/05/2015 | Authorised capital (non-cash capital increase) | 751,952 | 22,200,378 |

| 27/05/2015 | Authorised capital (non-cash capital increase) (Second of two entries) Contribution of 94% of the shares in Sihlegg Investments Holding GmbH for the acquisition of Gutenberg Galerie in Leipzig. (First of two entries) Contribution of 94% of the shares in Sihlegg Investments Holding GmbH for the acquisition of Gutenberg Galerie in Leipzig. | 1,430,615 | 21,448,426 |

| 20/05/2015 | Issue of subscription shares due to exercise of conversion rights from the 2013/2018 convertible bond | 77,950 | 20,017,811 |

| 22/01/2015 | Authorised capital (non-cash capital increase) | 5,633,710 | 19,939,861 |

| 18/11/2014 | Issue of subscription shares due to exercise of conversion rights from the 2013/2018 convertible bond | 411,500 | 14,306,151 |

Ratings

Analyst recommendations

Three financial analysts currently regularly evaluate and comment on DEMIRE’s business development.

Analyst recommendations

| Bank/broker | Analyst | Current rating | Current target price |

|---|---|---|---|

| Hauck & Aufhäuser | Philipp Sennewald | Hold | EUR 1.20 |

| Pareto Securities | Dr Philipp Häßler | Hold | EUR 1.30 |

| Baader Bank | Andre Remke | Reduce | EUR 1.25 |

Selected studies

- 6 June 2024 - NuWays - DEMIRE reaches agreement with bondholders

- 5 June 2024 - Baader Helvea - Company Flash: Agreement with a group of bondholders - Apollo makes committment

- 5 June 2024 - Pareto - Newsflash: Agreement with group of bondholders

- 23 May 2024 - Baader Helvea - Update: Wating on refinancing and further disposals

- 19 April 2024 - NuWays - Annual report postponed due to prolonged bond negotiations

- 28 March 2024 - NuWays - Mgmt confirms negotiations regarding bond restructuring

- 27 March 2024 - Pareto - Newsflash: Negotiations with group of bondholders confirmed

- 23 January 2024 - NuWays - Annual portfolio revaluation in line with expectations

- 17 January 2024 - Pareto - Update: 2024: some light at the end of the tunnel

- 16 January 2024 - NuWays - LogPark finally sold + letting success to start crucial 2024

- 22 December 2023 - Pareto - Newsflash: Sale of LogPark Leipzig to HIH Invest

- 24 November 2023 - NuWays - Another guidance adjustment following lack of disposals

- 24 November 2023 - Pareto - Newsflash: Guidance increase due to fewer property sales

- 10 November 2023 - NuWays - Solid Q3 but no refinancing solution yet; chg.

- 9 November 2023 - Pareto - Newsflash: Q3 results with mixed picture

- 10 August 2023 - NuWays - Extraordinary portfolio valuation reflects market weakness; chg.

- 6 July 2023 - NuWays - FY guidance adjusted after LogPark buyer withdraws/chg.

- 12 May 2023 - NuWays - No major surprises in Q1// Guidance confirmed

- 11 May 2023 - Pareto - Newsflash: Q1 results in line with our forecast on FFO I level

- 24 April 2023 - NuWays - Gearing up for '24 refinancing // Up to BUY

- 21 April 2023 - Pareto - Newsflash: Further buy back of outstanding bond

- 20 April 2023 - Pareto - Newsflash: Sale of property in Ulm

- 18 April 2023 - Pareto - Update: 2024 refinancing remains the key challenge

- 23 March 2023 - NuWays - Roadshow feedback: Refinancing remains the focus

- 17 March 2023 - NuWays - Update: FY 22: Guidance beat but outlook remains clouded / chg. est

- 16 March 2023 - Baader Helvea - Update: FY22 FFO above guidance (+5% yoy) but cautious guidance for FY23 due

to further disposals – No DPS proposal – Refinancing and LTV in focus - 16 March 2023 - Pareto - Newsflash: 2022 results with mixed picture

- 2 March 2023 - Baader Helvea - Update: The task remains to increase liquidity for refinancing

- 10 February 2023 - NuWays - Update: Cross read indicates valuation pressure; chg. est. & PT

- 30 December 2022 - Pareto - Newsflash: Sale of property in Leipzig

- 12 December 2022 - NuWays - Macro uncertainties weigh on stable operations

- 18 November 2022 - Hauck & Aufhäuser - No surprises in Q3 - outlook remains cloudy / chg. est. & PT

- 22 August 2022 – Hauck & Aufhäuser - Update: The outlook gets cloudier - down to hold

The analyst recommendations and, in particular, the key figures presented have not been prepared by DEMIRE Deutsche Mittelstand Real Estate AG. Furthermore, the performance estimates are not based on calculations by DEMIRE Deutsche Mittelstand Real Estate AG, but on analyses, reports, recommendations and assessments by third parties, in particular analysts, banks and research service providers. Reference to these recommendations and analyses is made purely for the reader’s information and is non-binding. DEMIRE Deutsche Mittelstand Real Estate AG hereby declares that it does not endorse or confirm the recommendations, analyses or conclusions of analysts, banks or research service providers presented here in any form whatsoever. DEMIRE Deutsche Mittelstand Real Estate AG does not accept any liability for the selection, updated status, completeness or accuracy of the analyst recommendations presented. The information contained on this website does not constitute an offer to sell or an invitation to subscribe for or purchase securities of DEMIRE Deutsche Mittelstand Real Estate AG. DEMIRE Deutsche Mittelstand Real Estate AG does not assume any liability for damages incurred by third parties based on the information contained on this website.

Share announcements

Voting rights notifications

Please note that some messages are available in English only

2022

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

Total voting rights

2018

2017

2016

2015

2014

Directors’ dealings

Transactions

2020 share buy-back II

On this page you will find all documents and information relating to the 2020 share buy-back II as announced on 8 December 2020.

2020 share buy-back

Cash capital increase, October 2018

On this page you will find all documents and information relating to the share buy-back as announced on 24 June 2020.

DISCLAIMER – IMPORTANT

The following materials are not directed at or to be accessed by persons located in the United States, Australia, Canada or Japan. These materials do not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States, Australia, Canada or Japan or in any other jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.

The securities mentioned herein have not been, and will not be, registered under the Securities Act and may not be offered or sold in the United States, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There will be no public offer of the securities in the United States.

In the United Kingdom the following materials are only directed at (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (ii) high net worth companies, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on the materials or any of their contents.

In relation to each member state of the European Economic Area which has implemented the Directive 2003/71/EC, and any amendments thereto (the “Prospectus Directive”) (each a “Relevant Member State”), an offer to the public of the securities has not been made and will not be made in such Relevant Member State, except that an offer to the public in such Relevant Member State of any securities may be made at any time under the following exemptions from the Prospectus Directive, if they have been implemented in the Relevant Member State:

a. to any legal entity which is a qualified investor as defined in the Prospectus Directive,

b. to fewer than 150 natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive, or

c. in any other circumstances falling within Article 3(2) of the Prospectus Directive;

provided that no such offer shall result in a requirement to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement a prospectus pursuant to Article 16 of the Prospectus Directive.

For the purposes of this provision, the expression an “offer to the public” in relation to any securities in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and any securities to be offered so as to enable an investor to decide to purchase any securities, as the same may be varied in that Relevant Member State by any measure implementing the Prospectus Directive in that Relevant Member State, and the expression “Prospectus Directive” includes any relevant implementing measure in each Relevant Member State.

Viewing the materials you seek to access may not be lawful in certain jurisdictions. In other jurisdictions, only certain categories of person may be allowed to view such materials. Any person who wishes to view these materials must first satisfy themselves that they are not subject to any local requirements that prohibit or restrict them from doing so.

If you are not permitted to view materials on this webpage or are in any doubt as to whether you are permitted to view these materials, please exit this webpage.

Basis of access

Access to electronic versions of these materials is being made available on this webpage by DEMIRE Deutsche Mittelstand Real Estate AG ( “DEMIRE“) in good faith and for information purposes only. Making press announcements and other documents available in electronic format on this webpage does not constitute an offer to sell or the solicitation of an offer to buy securities issued by DEMIRE. Further, it does not constitute a recommendation by DEMIRE, or any other party to buy or sell securities issued by DEMIRE.

Confirmation of understanding and acceptance of disclaimer

By clicking on the “I AGREE” button, I certify that I am not located in the United States, Australia, Canada or Japan or any other jurisdiction where access to the materials is prohibited or restricted.

I have read and understood the disclaimer set out above. I understand that it may affect my rights. I agree to be bound by its terms. By clicking on the “I AGREE” button, I confirm that I am permitted to proceed to electronic versions of these materials.

INFORMATION ON THE ANNOUNCED CASH CAPITAL INCREASE OCTOBER 2018

On this page you will find all documents and information about the Cash Capital increase announced on 25 October 2018.

- 26.10.2018 – Securities Prospectus

- 07.11.2018 – Supplement to Securities Prospectus

- 07.11.2018 – Ad hoc News: Adjusted forecast for the current fiscal year 2018

- Ad hoc News

Takeover bid by AEPF III 15 S.à.r.l.

Publication of inside information/Corporate news

Takeover bid for Fair Value REIT 2015

DISCLAIMER

DEMIRE Deutsche Mittelstand Real Estate AG

You have accessed the internet site that DEMIRE Deutsche Mittelstand Real Estate AG has designated for the publication of documents and information in connection with its voluntary public Takeover Offer for the shares of Fair Value REIT-AG.

IMPORTANT: You must read the following disclaimer in order to access the following websites.

On the following pages, DEMIRE Deutsche Mittelstand Real Estate AG has published a takeover offer to acquire the shares of Fair Value REIT-AG (the “Takeover Offer”), which constitutes a public takeover offer pursuant to the German Securities Acquisition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz, “WpÜG”), the notification on the decision to submit a takeover offer pursuant to § 10 para. 1 in conjunction with §§ 29 para. 1, 34 of the WpÜG, additional mandatory publications pursuant to the WpÜG and additional information in connection with this Takeover Offer. The Takeover Offer is being submitted solely in accordance with the relevant laws of the Federal Republic of Germany and, in particular, in accordance with the provisions of the WpÜG in conjunction with the German Regulation on the Contents of Offer Documents, Considerations Related to Takeover Offers and Mandatory Offers and Exemptions from the Obligation to Publish and Submit an Offer (WpÜG-Angebotsverordnung). The Takeover Offer is not made or intended to be made pursuant to the statutory provisions of other legal systems. Accordingly, no notifications, registrations, admissions or approvals of the Takeover Offer and/or of the offer document containing the Takeover Offer have been or will be applied for or initiated by DEMIRE Deutsche Mittelstand Real Estate AG or the persons acting in concert with DEMIRE Deutsche Mittelstand Real Estate AG outside of the Federal Republic of Germany. DEMIRE Deutsche Mittelstand Real Estate AG and the persons acting in concert with DEMIRE Deutsche Mittelstand Real Estate AG therefore do not accept any responsibility for compliance with any laws other than those of the Federal Republic of Germany.

DEMIRE Deutsche Mittelstand Real Estate AG does not intend to submit and publish or publicly advertise the Takeover Offer pursuant to the laws of any jurisdiction other than the Federal Republic of Germany. Neither DEMIRE Deutsche Mittelstand Real Estate AG nor any person acting in concert with DEMIRE Deutsche Mittelstand Real Estate AG as defined by § 2 para. 5 sentences 1 and 3 of the WpÜG nor any of its or their subsidiaries will pursue or otherwise facilitate the public marketing of the Takeover Offer outside the Federal Republic of Germany.

DEMIRE Deutsche Mittelstand Real Estate AG and the persons acting in concert with DEMIRE Deutsche Mittelstand Real Estate AG accept no responsibility for the publication, dissemination, dispatch, distribution or transfer of any documents connected with the Takeover Offer or the acceptance of the intended Takeover Offer outside the Federal Republic of Germany being permissible under the respective provisions of other legal systems. Furthermore, the responsibility of DEMIRE Deutsche Mittelstand Real Estate AG and the persons acting in concert with DEMIRE Deutsche Mittelstand Real Estate AG for the non-compliance with any legal provisions by third parties is expressly excluded.

The announcements made on this website do not constitute an invitation to make an offer to sell or exchange shares in Fair Value REIT-AG. With the exception of the offer document, announcements made on this website also do not constitute an offer to purchase or exchange shares in Fair Value REIT-AG.

Shares of DEMIRE Deutsche Mittelstand Real Estate AG have not been nor will they be registered under the U.S. Securities Act of 1933, as amended, or with any securities regulatory authority of a state or any other jurisdiction in the USA or any other foreign jurisdiction. Therefore, subject to certain exceptions, DEMIRE Deutsche Mittelstand Real Estate AG shares must not be offered or sold within the USA or any other jurisdiction where to do so would constitute a violation of the national laws of such jurisdiction. There will be no registration of the DEMIRE Deutsche Mittelstand Real Estate AG shares mentioned in this announcement pursuant to the relevant laws in the USA or any other foreign legal system.

If any announcements on this website contain forward-looking statements, such statements do not represent facts and are characterised by the words “will”, “expect”, “believe”, “estimate”, “intend”, “aim”, “assume” or similar expressions. Such statements express the intentions, opinions or current expectations and assumptions of DEMIRE Deutsche Mittelstand Real Estate AG and the persons acting in concert with DEMIRE Deutsche Mittelstand Real Estate AG, for example with regard to the potential consequences of the Takeover Offer for Fair Value REIT-AG, for those shareholders of Fair Value REIT-AG who choose not to accept the Takeover Offer or for future financial results of Fair Value REIT-AG. Such forward-looking statements are based on current plans, estimates and forecasts which DEMIRE Deutsche Mittelstand Real Estate AG and the persons acting in concert with DEMIRE Deutsche Mittelstand Real Estate AG have made to the best of their knowledge, but which do not claim to be correct in the future. Forward-looking statements are subject to risks and uncertainties that are difficult to predict and usually cannot be influenced by DEMIRE Deutsche Mittelstand Real Estate AG or the persons acting in concert with DEMIRE Deutsche Mittelstand Real Estate AG. It should be considered that the actual events or consequences may differ materially from those contained in or expressed by such forward-looking statements.

By selecting the “I agree.” button, you state that you read the disclaimer.

If you have any questions, please contact DEMIRE Deutsche Mittelstand Real Estate AG’s Investors Relations department by telephone at +49 (0)6103 372 49 44 or in writing to Robert-Bosch-Str. 11, 63225 Langen, Germany.

INFORMATION ON TAKEOVER OFFER

21 December 2015 – Ad-hoc-announcement: DEMIRE successfully concludes voluntary public takeover offer to Fair Value REIT-AG shareholders

21 December 2015 – Announcement regarding the fulfillment of all Closing Conditions pursuant to section 12.5 of the Offer Document

21 Dezember 2015 – Addition to prospectus [PDF German] Nachtrag Nr. 1 vom 21. Dezember 2015 gemäß § 16 Abs. 1 Wertpapierprospektgesetz zum Wertpapierprospekt

21 December 2015 – Prospectus [PDF German] Wertpapierprospekt für die Zulassung zum regulierten Markt (General Standard) an der Frankfurter Wertpapierbörse von 21.927.756 auf den Inhaber lautenden Stammaktien ohne Nennbetrag (Stückaktien)

11 December 2015 – “Announcement regarding the discontinuance of the stock exchange dealing in tendered Fair Value Shares

08 December 2015 – Announcement pursuant to § 23 (1) sentence 1 no. 3 of the German Securities Acquisition and Takeover Act (WpÜG)

19 November 2015 – Announcement pursuant to § 23 (1) sentence 1 no. 2 of the German Securities Acquisition and Takeover Act (WpÜG) as well as regarding the fulfillment of Closing Conditions

16 November 2015 – 8. Announcement pursuant to § 23 (1) sentence 1 no. 1 of the German Securities Acquisition and Takeover Act (WpÜG)

13 November 2015 – 7. Announcement pursuant to § 23 (1) sentence 1 no. 1 of the German Securities Acquisition and Takeover Act (WpÜG)

12 November 2015 – 6. Announcement pursuant to § 23 (1) sentence 1 no. 1 of the German Securities Acquisition and Takeover Act (WpÜG)

12 November, 2015 – Ad-hoc: Takeover Offer Fair Value REIT-AG – Minimum acceptance rate exceeded

11 November 2015 – 5. Announcement pursuant to § 23 (1) sentence 1 no. 1 of the German Securities Acquisition and Takeover Act (WpÜG)

10 November 2015 – 4. Announcement pursuant to § 23 (1) sentence 1 no. 1 of the German Securities Acquisition and Takeover Act (WpÜG)

4 November 2015 – 3. Announcement pursuant to § 23 (1) sentence 1 no. 1 of the German Securities Acquisition and Takeover Act (WpÜG)

28 October 2015 – 2. Announcement pursuant to § 23 (1) sentence 1 no. 1 of the German Securities Acquisition and Takeover Act (WpÜG)

21 October 2015 – 1. Announcement pursuant to § 23 (1) sentence 1 no. 1 of the German Securities Acquisition and Takeover Act (WpÜG)

14 October 2015 – Offer Document (German)

14 October 2015 – Announcement pursuant to § 14 (3), sentence 1, no. 2 of the German Securities Acquisition and Takeover Act

31 July 2015 – Publication pursuant to § 10 para. 1 in conjunction with §§ 29 para. 1, 34 of the Securities Acquisition and Takeover Act